Blog

Zakat Calculator UK for Joint Accounts and Shared Wealth

The joint accounts or shared assets of many of the Muslims in the UK are among family members, spouses, or business partners. It is also confusing to calculate zakat on such accounts since only the part that is legally in your possession or you are entitled to is zakatable. It becomes simple with a Zakat Calculator UK which ensures that it complies with the Shariah laws without overpayment or underpayment.

Appreciating Joint Accounts and Shared Wealth

The joint account may consist of savings made in the bank, investment accounts, or even business assets. Shariah law focuses on the fact that zakat is payable only on your portion of ownership. As an example, when you are a co-owner of a savings account with your spouse, only the percentage of the balance is zakatable. In a similar manner, there should be division of shared business or investment accounts based on legal ownership or agreed shares.

How a Zakat Calculator Helps

One of the UK Zakat Calculators enables a user to:

- Balances of input joint accounts.

- State the shareholding percentage.

- Add other common properties such as rental income, investments or gold.

- Calculator will automatically charge the 2.5 percent zakat on the portion therefore making it easier to perform statistics and be precise.

Calculating Your Share

In order to determine the zakat due on collective wealth:

- Establish combined account balance or value of asset.

- Establish your part in the legal ownership (e.g., in the jointly held account 50 percent is the legal ownership share).

- Indicate whether the share is nisab threshold or not.

- Calculate zakat by applying 2.5% on your share.

Advice on Precise Calculation

- Maintain comprehensive documents of joint property and property arrangements.

- You have to update your Zakat Calculator with changes in balances or asset value.

- Agreements on ownership shares may be vague or complex, then seek advice of a local Islamic scholar.

Advocacies of a UK Zakat Calculator to Share Holdings

- Avoids overpayment by making sure that only your portion is counted.

- Timesaving automated calculations.

- Ensures Shariah compliance to joint or partnership accounts.

- Increases financial awareness of individual zakatable portions.

Conclusion

The UK has joint accounts and shared wealth, thus complicating the calculating of zakat. Zakat Calculator UK will be used to make sure that you will only pay zakat on what you are supposed to, and this keeps it accurate and compliant with the Islamic law. Through the use of monitoring your share of joint accounts, investments, and partnerships, you can complete your zakat duty with a feeling of confidence and justice without committing mistakes when helping other people positively at charitable works.

-

Celebrity5 months ago

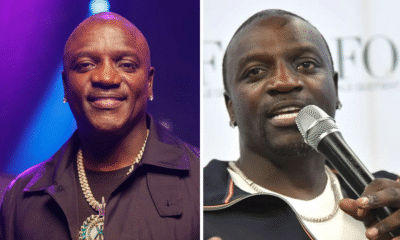

Celebrity5 months agoThe Story Behind Akon’s Net Worth and His Rise to Fame

-

Celebrity9 months ago

Celebrity9 months agoPeter Tuchman Net Worth Revealed: The Face Behind Wall Street’s Chaos

-

Fashion10 months ago

Fashion10 months agoAron Accurso Net Worth: A Look Into the Musical Genius Behind Ms. Rachel

-

Celebrity3 months ago

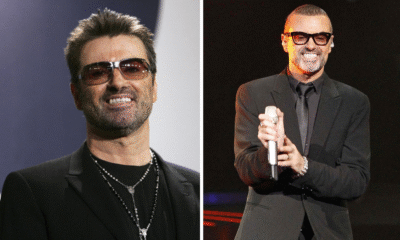

Celebrity3 months agoGeorge Michael’s Net Worth and the Stories You Might Not Know